August 21, 2015

(posted Monday, 8/24)

My close friend, and sole proprietor of an energy business, is fond of saying “Work would be great, if it wasn’t for the people”. This week Walmart announced they missed their earnings target due to shrinkage.

Wal-Mart US President Greg Foran said Tuesday that theft, which the company calls shrinkage, is one of three major factors behind the retailer’s drop in profit in the most recent quarter. “Inventory shrinkage was meaningfully higher than planned for the quarter,” Foran said in an earnings call.

Wal-Mart likely loses about 1% of its US revenue – or roughly $3 billion dollars every year – to stealing by customers and employees.(Yahoo Finance)

Negative inspirations are humorous, but contain a kernel of truth;

“No good deed goes unpunished”

“Bad news sells papers”

“Don’t let a good crisis go to waste”

“When a politican sees the light at the end of the tunnel, he orders more tunnel”

I have said in previous newsletters and recent phone conversations, that I am expecting weakness in the market. This will provide us with a better entry level. Here is some good news to hold us over concerning the economy which you may have missed.

This list of good news and positive developments comes from First Trust’s Chief Market Strategist Bob Carey . (Quarterly Market Overview)

- U.S. nonfarm payrolls have increased for 57 consecutive months through June 2015. (Bureau of Labor Statistics)

- The S&P/Experian Consumer Credit Default Composite Index stood at 0.88% in May 2015, a record low for the index. (Bloomberg)

- U.S. auto sales hit a monthly annualized pace of 17.11 million units in June 2015. Sales bottomed during the recession at 9.04 million (annualized) in May 2009. (Bloomberg)

- CoreLogic reported that, as of May 2015, home prices had reached an alltime high in 10 states and the District of Columbia. Thirty-three states were within 10% of their price peaks. (CNBC)

- In Q1’15, S&P 500 companies distributed $93.55 billion in stock dividends, a record high for a single quarter. (S&P Dow Jones Indices)

- The S&P 500 Industrials (Old) companies (excludes Financials, Utilities and Transportation issues) held $1.23 trillion in cash and equivalents on 3/31/15. (S&P Dow Jones Indices) The all-time high was $1.33 trillion on 12/31/14.

- The Federal Reserve reported that the net worth of U.S. households and nonprofit organizations stood at a record $84.9 trillion in Q1’15. (The Wall Street Journal)

- From Q1’11 through Q1’15, S&P 500 companies increased their spending on buybacks and stock dividends from $546.02 billion to $900.14 billion. That represents a 64.9% increase in spending.

- The FTSE NAREIT All Equity REITs (Real Estate Investment Trusts) Total Return Index closed 7.48% below its all-time high on 8/14/15, according to Bloomberg.

LISTENING TO THE MARKETS

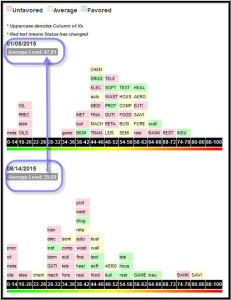

To be fair, despite all the good news mentioned above, there are developments that have raised the “yellow flag” of caution.

The 50/200 day moving average of Dow Jones Industrial Average (DIA) is slightly negative.

The 50/200 day moving average of Transportation Stocks (IYT) is negative.

The 50/200 day moving average of Utility Stocks (XLU) is negative.

The 40 Broad S&P 500 Sectors have pulled back from 47.81% to a more attractive 39.68%.

Patience is perhaps the most difficult personality trait among investors. Investors seem to be “chomping at the bit”, wanting to buy stocks at the market, rather than letting the market come to them. If we get a typical decline, the S&P 500 should trade from its high of 2,120 making the first stop at 2,000; and hopefully the 1,800 to 1,760 area. I say hopefully because we should buy with “both hands” if the market trades at those levels.

“Patience, persistence and perspiration make an unbeatable combination for success.” Napoleon Hill

Under no circumstances should any of our clients embrace a posture of fear when watching the news or talking with friends. This is a normal, healthy correction. High dividend, Oil stocks in particular are enticing around here for long term holders.

As of August 18th, our unaudited SMART4 model strategy is up 9.86% in YTD 2015 compared to 1.85% in the S&P 500 (SPY) , -1.43% for the Dow Jones Industrial (DIA), and +7.37% in the NASDAQ (QQQ). Individual client accounts may differ. Click here for more information about the SMART4.

Feel free to forward this newletter along to anyone you think would enjoy reading it.

Enjoy the rest of your summer,

Bill Ulivieri

Disclaimer:

Cenacle Capital Management is a State of Illinois registered investment advisor. IARD 130804

PLEASE READ THIS WARNING: All email sent to or from this address will be received or otherwise recorded by Cenacle Capital Management LLC corporate email system and is subject to archival, monitoring and/or review, by and/or disclosure to, someone other than the recipient. This message is intended only for the use of the person(s) to whom it is addressed. It may contain information that is privileged and confidential.

If you are not the intended recipient, please contact the sender as soon as possible and delete the message without reading it or making a copy. Any dissemination, distribution, copying, or other use of this message or any of its content by any person other than the intended recipient is strictly prohibited.

Cenacle Capital Management LLC has taken precautions to screen this email for viruses, but we cannot guarantee that it is virus free, nor are we responsible for any damage that may be caused by this message.

Cenacle Capital Management LLC only transacts business in states where it is properly registered or notice filed, or excluded or exempted from registration requirements. Follow-up and individual responses that involve either the affecting or attempting to affect transactions in securities, or the rendering of personalized investment advice for compensation, as the case may be, will not be made absent compliance with state investment adviser and investment adviser representative registration requirements, or an applicable exemption or exclusion.

Past returns are not a guarantee of future results.

Please contact Cenacle Capital Management, LLC if there are any changes in your financial situation or investment objectives, or if you wish to impose,add or modify any reasonable restrictions to the management of your account. Our current disclosure statement is set forth on Part II of Form ADV and is available for your review upon request.