Which Mutual Funds Should CBOE Employees Choose in Their 401(k) Plan?

A little over a year ago, a former Chicago Board Option Exchange (CBOE) employee and I were having a conversation about the list of mutual funds offered to employees in their 401(k) Plan. My second job in the industry, circa 1981, was an Exchange “book clerk”. I spent the next 30 years of my career associated in the Options Industry, either as a pit trader, firm trader or risk manager. The CBOE was a magical place to be.

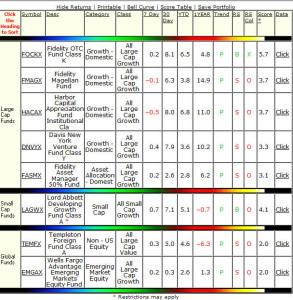

Of the  eight equity funds in the (old) list, only the global funds had weak relative strength scores compared to the other funds. Using

eight equity funds in the (old) list, only the global funds had weak relative strength scores compared to the other funds. Using

relative strength to score funds does not guarantee profitability, but it does provide an indication that a particular asset class is going to outperform or underperform the S&P 500 on a relative basis. ( See image for the “old” list of funds run on 3/1/2015)

Morningstar ratings help investors quickly identify mutual funds that are performing well. The only downside is that the ratings are generally based on 1, 3 & 5 year historical returns. (1)

To me,that’s like driving a car using only the rearview mirror.

Using Relative Strength as a tool to identify mutual funds worthy of investment can help provide investors information in real time.

This gives investors a heads-up when asset class leadership begins to change; today. Fund scores above a “3.0” indicate better than average relative strength. Fund scores below 2.9 provide an indication that money is best allocated elsewhere. A score rating above “5.0”, means there are a lot of good things to like about a fund.

If any current or past employees of the CBOE provide me with a current list of mutual funds offered in your 401(k) Plan, I would be happy to run an updated list of mutual fund scores. You know…for old times sake.

Regards,

Bill Ulivieri-Principal

Formerly “YEA” member badge

Remember, past performance is no indication of future returns. See disclaimer link below.

https://cenaclecapital.com/about-cenacle/disclaimer/

(1): http://www.morningstar.com/InvGlossary/morningstar_rating_for_funds.aspx