There have been a lot of discussions across social media, especially Twitter, that give a market-maker improper credit for manipulating stocks, futures and cryptocurrency markets. It’s important not to confuse the role or exchange function, with a trading strategy. A market-makers role is to..well, make a two-sided market, otherwise know as the “bid ask” spread.

Here is my first draft attempt to explain the various roles and workings within the historical context of professional traders at a regulated Exchange. Not all of these descriptions carry over to the world of unregulated Exchanges.

Opinions are my own and this article is for informational and entertainment purposes only.

The Players

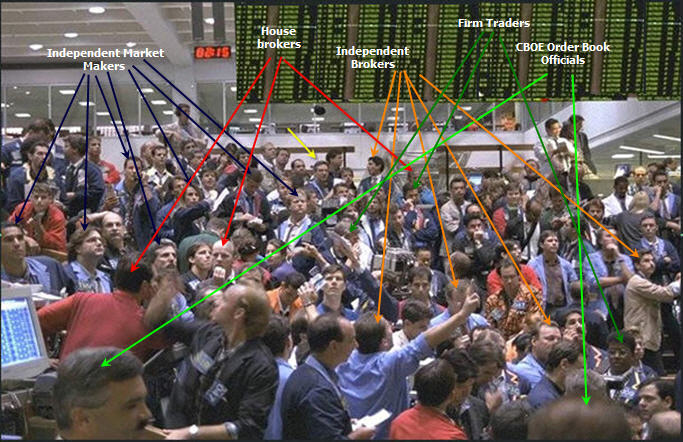

CBOE OEX options pit circa 1996

Yellow arrow is me

House Brokers

Color: Red

Compensation: Salary + Bonus

Loyalty: His Employer

Brokerage firms like Schwab, Merrill Lynch, Goldman, Chicago Corp., etc., hired personnel who took the membership exam and became floor brokers.

House brokers are salaried employees of the firm and only executed or represented orders for the firm that employed them. Mistakes and improperly executed orders were placed in a trading “Error Account”. Neither too great a gain; nor too large a loss was desirable. At the end of a year, if a house brokers error account was “net zero” P&L or slightly positive, he was okay with that. The house brokers did not keep gains, nor were they penalized if there were reasonable losses. Too large a loss would get them fired. The Firm took all the risk, so the Firm kept gains if any, in the error account. Active pits like the OEX, S&P 500, IBM had a dedicated broker stations.

Floor Broker. Independent

(a.k.a a $2 Dollar brokers)

Color: Orange

Compensation. Commissions per contract

Loyalty. Himself / Clients

Independent Floor brokers were individual members or a group of members who executed orders for their own business gain. If the amount of commissions billed at the end of the month was greater than monthly seat lease, clearing fees, errors, expenses, etc. then the independent broker had a successful business. Volume was key. The more orders executed, the more money you made. The Clearing firm was responsible for guaranteeing the broker against large losses. Independent brokers primarily executed order only for another exchange member.

Floating Broker

Compensation. Generally salaried

Loyalty: Employer

Color: Not Shown

Most independent brokers or broker groups stayed in the same pit every single trading day for decades.

Floating brokers had no allegiance per se, but would execute orders in any pit, in any size as long as it could be executed quickly. If a Floating broker couldn’t execute the order quickly, they would hand it off to an independent broker who was then responsible for time stamping, filing, watching, executing, holding and returning order to the desk.

Order Book Official Board Broker *

Compensation. Salaried employee of an Exchange, responsible for representing the public, retail, customer. (CBOE Only)

Loyalty: To the Exchange and the retail customer.

Color: Neon Green

The main structural difference between the Chicago Board Options Exchange (CBOE), Chicago Board of Trade (CBOT) and the Chicago Mercantile Exchange (CME) was that the CBOE did NOT PERMIT DUAL TRADING. A broker at the other exchanges could and often did, traded for their own personal accounts (proprietary) while representing a customer order (agency). Retail clients at the CBOE were assured their order was represented and executed by a disinterested 3rd party; an Exchange member whose only task was to represent John Q. Public.

Buy Broker

Compensation: Salary + Bonus

Loyalty- Employer

Generally a salaried employee of a broker-dealer, only responsible for BUY orders. Brokers were segregated into “Buy” and “Sell” brokers to eliminate confusion and reduce costly errors in fast markets especially during the summer months. Typically found in Agricultural pits like corn and soybeans. The most costly and expensive errors were a buy order executed as a sell, or a sell order mistakenly executed as if it was a buy.

Sell Broker

Compensation: Salary + Bonus

Loyalty- Employer

Generally a salaried employee of a broker dealer, only responsible for SELL orders. Brokers were segregated into Buy and Sell brokers to eliminate confusion and reduce costly errors in fast markets or the summer months. Typically found in Agricultural grains like corn and soybeans. The most costly and expensive errors were a buy order executed as a sell order; or a sell order executed as if it was a buy order.

Spread Broker

Compensation: Salary + Bonus

Compensation: Commission fees

Generally, but not always a salaried employee of a broker dealer, only responsible for SPREAD orders. Examples of Spread orders are “Buy March; Sell December”, or “Buy September; Sell March” for a debit or credit. Most likely found in the grain pits, down several steps in the middle of an octagon shaped pit. Front month futures were executed on the “top step” or vertically highest part of the trading pit.

Market Maker

Independent Trader

Compensation: Solely net gains made from trading

Loyalty: Himself

Color: Dark Blue

Independent traders funded their accounts with “seed money” used to start trading. This either came out of their personal savings, a loan from a family member, or a successful trader would “back” them with a loan against future profits. Terms were Prime rate + 1% or Prime rate + 2% and a 60/40 split of net profits or 70/30 split after expenses. Often the backer would own more than one Exchange “seat” and lease it to the trader for whatever the current monthly seat lease rates. Monthly rates varied from $1,200 per month to $12,000 per month, depending on volume and the current market price of the Exchange membership.

Market makers could trade with other market makers, and brokers of any type. Markets makers had an OBLIGATION to verbally respond with a two-sided market if requested by a broker or board broker. Market makers were NOT obligated to respond for a request of a market from a competing market maker. Market makers had to follow strict Exchange guidelines as to the maximum spread width permitted.

Market Maker / Firm Trader

Compensation: Salary + Bonus

Loyalty: Employer

Color: Lime green

Firm traders became popular when traders used computers to generate theoretical option values based upon the Black-Scholes option pricing model. Firms like Timber Hill, Susquehanna, Chicago Research & Trading and many more hired a plethora of staff and positioned them in all the trading pits. These guys were good, but in most cases only little freedom in making independent trading decisions.

MARKET MAKER STRATEGIES

There is a misconception that Market makers are delta neutral, and look purely to make the bid-ask spread. This is not true. All market maker are traders, but not all traders look purely to make the bid ask differential. Market makers are not whales, and will not commit huge sums of money to speculative trades. There is too much money to be made in the bid-ask spread, that it isn’t necessary to take undue risk.

“RISK NOT THY WHOLE WAD”

Scalper is a floor based, market-maker who looks to profit from trading the difference in the bid / ask spread. Thousands of contracts per day. Scalpers go home completely “flat” or neutral in most cases. They only take intra-day risk.

Spreaders can be floor based or upstairs traders entering order to brokers. They will spread OEX vs. SPX, Wheat vs. Corn, one month vs. another. Anything that can be spread will be spread.

Arbitrage traders only trade when there is something “out of line”. The price of a series of call or put options; or a June /Dec futures spread as examples. Arbitrage strategies are boxes, conversions, & reverse conversions. These are first and foremost risk-free interest rate trades.

Shooters are speculators who patiently wait for the right trading opportunity and “load the boat” taking as much risk as they can afford to lose, or can make back quickly.

Trading the Range is a trading technique that generally waits until the first 30 minutes after the opening bell to see where intra-day resistance and support levels might be. Once levels have been established a trader will use those levels for stop loss and reversal strategies. My memory is a little rusty but traders used John Stademeyer (sp) “bellcurve” techniques with varied success.

Technical Traders were market-makers and used RS, stochastics, Bollinger Bands, momentum and dozens of other “tools of information” to give you an edge. Basically these are all averages to alert the trader to divergence.