April 4, 2016

What makes a “market” is when buyers and sellers with different opinions finally agree on a price. It doesn’t matter if we’re discussing tomatoes, cars, houses or stocks. There are SO many different opinions about where the market is going, and this is precisely what makes it so much fun! Since the low made on February 11, 2016, stocks have staged a strong, unexpected rally, closing + 1.17% on the year. IMHO, Oil stocks have found a bottom, representing attractive dividend yields and long term opportunities.

What makes a “market” is when buyers and sellers with different opinions finally agree on a price. It doesn’t matter if we’re discussing tomatoes, cars, houses or stocks. There are SO many different opinions about where the market is going, and this is precisely what makes it so much fun! Since the low made on February 11, 2016, stocks have staged a strong, unexpected rally, closing + 1.17% on the year. IMHO, Oil stocks have found a bottom, representing attractive dividend yields and long term opportunities.

IMHO

Speaking of opinions, just look at the titles from the books given to me from friends over the years. Each friend, while handing me the book said something to the effect; “I know you’re investing money for people, so you should know what’s going on, and consider selling everything”. It’s their opinion that I should put all client assets; your assets into money market funds and beg you to stock up on guns. In every instance, the stock market is substantially higher since it was published. I’ve included the rate of return of the Standard & Poor 500; NOT including dividends for the period of when a book debuted to the time of this writing.

(Publishing dates from Amazon.com)

Check this out.

Boom Bustology

Published March 8, 2011

S&P 500 up +56.07%

The Dollar Crisis

Published June 22, 2005

S&P 500 up +70.21%.

US Dollar Index +6.79%

A Bull In China

Published December 30, 2008

S&P 500 up + 132.57%

Dow Jones China 88 +54.98%

Contrary Investing for the 90s

Published January 1, 1990

S&P 500 up +509.69%

The Black Swan

Published April 17,2006

S&P 500 up +60.83%

The Great Depression Ahead

Published January 6, 2009

S&P 500 up + 121.38%

In case you were wondering, I’ve donated these books to the local public library. With respect to the opinion of these well meaning investment specialists, and I mean that sincerely, I still remain convinced that 100% of the near‐tripling of equity values since 2008 is directly attributable to the very attributes and forces that have been driving equity prices higher since the dawn of this Nation:

Life, Liberty and the Pursuit of Happiness drive innovation, growth of company earnings, cash flow, dividends and the magnanimous desire to increase the standard of living of all mankind. It’s the manifestation of an unleashed human spirit and an ability to monetize the ingenuity of man for the betterment of self and the world. I fully expect these trends to continue for the remainder of this Millennium.

The stock market is not a conspiracy to rip us off. It’s a wealth building machine which can provide us with a remarkable standard of living in retirement as long as we (or the Government) doesn’t stand in its way.

How We’ll Know the Economic Expansion is Near the End of a Normal Cycle

I’m not so naive as to believe those temporary but severe market declines don’t damage our emotions or bruise our retirement plans. Expansions and contractions are part of the game which give us attractive returns over time. In my experience, great advances in equity values haven’t usually ended while the public’s default setting was terror.

The most significant market tops I’ve seen‐in early 1987, 2000, and 2006‐07,took place at the height of speculative manias, where the fear most investors exhibited was that everybody else might be making more money than they were. This is a conversation you may want to have with your financial advisor, whose greatest value to you is not the timing the market’s peaks and troughs‐which no one can consistently do‐but in coaching and holding your hand so you don’t overreact to them.

This Is Where We Earn Our Fee

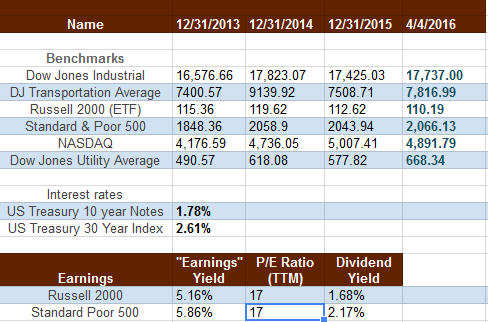

Portfolio gains have not been easy to attain since 2013 as seen on the benchmark grid below (1), but the market is still yielding almost 3 times more than the 10 year US Treasury notes, with banks in the strongest financial position in over 10 years.

Please consider sharing this newsletter along to friends, colleagues, or family members using the link provided at the very bottom of this page.

Warm Regards,

Bill

(1) Prices from Yahoo Finance

Cenacle Capital Management is a Illinois registered investment advisor. PLEASE READ THIS WARNING: All email sent to or from this address will be received or otherwise recorded by Cenacle Capital Management LLC corporate email system and is subject to archival, monitoring and/or review, by and/or disclosure to, someone other than the recipient. This message is intended only for the use of the person(s) to whom it is addressed. It may contain information that is privileged and confidential. If you are not the intended recipient, please contact the sender as soon as possible and delete the message without reading it or making a copy. Any

dissemination, distribution, copying, or other use of this message or any of its content by any person other than the intended recipient is strictly prohibited.

Cenacle Capital Management LLC has taken precautions to screen this email for viruses, but we cannot guarantee that it is virus free, nor are we responsible for any damage that may be caused by this message. Cenacle Capital Management LLC only transacts business in states where it is properly registered or notice filed, or excluded or exempted from registration

requirements. Follow‐up and individual responses that involve either the affecting or attempting to affect transactions in securities, or the rendering of personalized investment advice for compensation, as the case may be, will not be made absent compliance with state investment adviser and investment adviser representative registration requirements, or an applicable exemption or

exclusion.

Past returns are not a guarantee of future results. Please contact Cenacle Capital Management, LLC if there are any changes in your

financial situation or investment objectives, or if you wish to impose,add or modify any reasonable restrictions to the management of your account. Our current disclosure statement is set forth on Part II of Form ADV and is available

for your review upon request.