How Bitcoin Compares to Gold & World Currency ETF’s

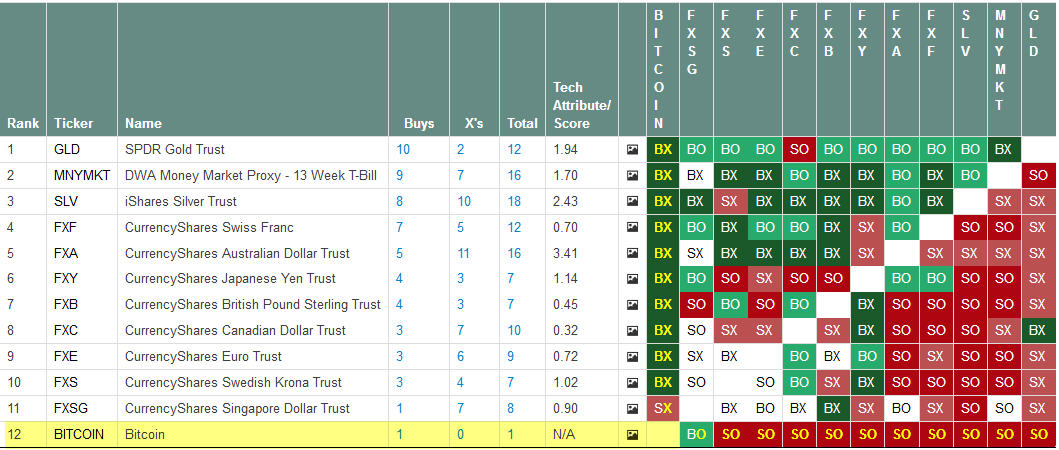

Danger Will Robinson! How quickly things change. Bitcoin has fallen from first place, to last place in terms of its relative strength with other asset classes. Caution must be exercised with Bitcoin investment at this time, as the chart below implies it may be the worst performing asset class in the short term.

The Bitcoin Matrix below uses relative strength technical analysis to show how Bitcoin ranks against foreign currency Exchange Traded Funds (ETFs) and other asset classes like Gold and Silver listed on US exchanges. Top relative strength candidates “float to the top”; while weaker candidates “sink to the bottom”. Click chart to enlarge.

HOW TO READ THIS CHART

- Relative strength measures the performance of one security in comparison to another. For example, how Microsoft is performing compared to the S&P 500, or how the U.S. Dollar is doing relative to the Euro, or how Bitcoin is doing relative to other Exchange Traded Funds and asset classes. To calculate relative strength, take the price of one security and divide it by the other (the security you want to compare), then plot the daily values using Point & Figure charting. While relative strength signals last on average about two years, an investor can also look to relative strength relationships for near term guidance.

- Technical Attributes/Score is a ranking system that is applied to all ETFs using both trend and relative strength analysis. Stocks & ETF’s with at least 3 out of 5 technical attributes positive are considered to be “solid citizens”, and are desirable to buy or hold. Stocks with 2 or fewer technical attributes are most vulnerable to declines. The chart is organized by four horizontal lines using a demarcation percentile.

- Chart courtesy of Dorsey Wright & Associates. Please read our Disclaimer at: https://cenaclecapital.com/about-cenacle/disclaimer/

- For informational purpose only. Not a recommendation to buy or sell. We own small positions in Bitcoin, Ethereum and other alt-currencies, and operate mining rigs to acquire these and other tokens.

- For more information about Guggenheim Currency Shares visit https://www.currencyshares.com/about-us/product-attributes

- Relative Strength Matrix methodology is not a guarantee. Securities are ranked within a matrix relative to one another. There may be times where all securities in a given inventory are unfavorable and depreciate in value. The Relative Strength Matrix does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation (express or implied) clients should consider whether the security or strategy in question is suitable for their particular circumstances, and, if necessary, seek professional advice. Past performance is no guarantee of future results. Potential for profits is accompanied by possibility of loss.

- At the time of this writing, Bitcoin has not been approved, classified or even recognized as a currency, security or property suitable for investment.