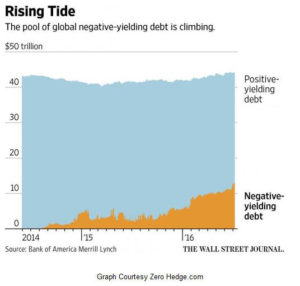

On July 13th, the financial media reported “Germany sold 10-year debt at a negative yield on Wednesday, becoming the first eurozone nation to do so and setting a further milestone in the relentless fall of government bond yields around the world.” (1)

On July 13th, the financial media reported “Germany sold 10-year debt at a negative yield on Wednesday, becoming the first eurozone nation to do so and setting a further milestone in the relentless fall of government bond yields around the world.” (1)

Negative yield bonds guarantee the investor will lose money if held to maturity, and with a 0% coupon, not receiving any annual interest payments. This does not include the corrosive loss in purchasing power due to currency fluctuations and inflation.

The only hope of earning money is to sell the bond for a capital gain. Investors seeking capital gains from negative yield bonds, is conceptually no different than the commercial real estate investor in 2007, who chased rental units with negative capitalization rates, seeking only to profit from “flipping” the property at a later date. Capital gain is a secondary consideration for the real estate investor. Cash flow ( a.k.a. “income”) is primary.

ERISA Section 404(a), requires a fiduciary to discharge his or her duties with respect to a plan solely in the interest of the participants and beneficiaries and—(A) for the exclusive purpose of: (i) providing benefits to participants and their beneficiaries; and (ii) defraying reasonable expenses of administering the plan; (B) with the care, skill, prudence, and diligence under the circumstances then prevailing that a prudent person acting in a like capacity and familiar with such matters would use in the conduct of an enterprise of a like character and with like aims; (C) by diversifying the investments of the plan so as to minimize the risk of large losses, unless under the circumstances it is clearly prudent not to do so.

My goal is not to definitively answer potential ERISA violations, but ask further questions arriving at greater clarity.

1. Would a “prudent expert” purchase an investment, if held to maturity guarantee a loss to a portfolio?

2. Are negative yields an ERISA violation since the fiduciary is not defraying reasonable expenses of administering the plan?

3. Will purchasing a negative yield bond, maximize the risk of “large losses” since a 0% coupon pays no annual income?

4. If sovereign bonds guarantee a loss if held to maturity, will pensions be subject to similar ERISA “stock drop” lawsuits,

( ex: Fifth Third Bank vs. Dudenhoeffer) where petitioners argued ownership of company stock was “excessively risky”? (2)

5. Is it in the best interest of plan participants and beneficiaries to premeditate an investment purchase with a guaranteed loss to maturity?

I’m uncertain as what motivates an investor to purchase any bond with a negative yield, but any prudent expert paying attention since 2007 knows this is not going to end well.

Footnotes:

(1) http://www.wsj.com/articles/germany-sells-10-year-debt-at-negative-yield-1468410101

(2) https://www.google.com/search?q=Dudenhoffer&ie=utf-8&oe=utf-8#q=Dudenhoeffer

(3) Chart http://www.zerohedge.com/news/2016-07-10/over-13-trillion-negative-yielding-debt-pain-1-spike-rates-would-inflict

Disclaimer: Cenacle Capital Management LLC only transacts business in states where it is properly registered or notice filed, or excluded or exempted from registration requirements. Follow-up and individual responses that involve either the affecting or attempting to affect transactions in securities, or the rendering of personalized investment advice for compensation, as the case may be, will not be made absent compliance with state investment adviser and investment adviser representative registration requirements, or an applicable exemption or exclusion.

Past returns are not a guarantee of future results.