Dear Family and Friends of Cenacle, ( re-purposed from February 21, 2014)

I had the pleasure of being interviewed by radio host Sean Herriott from Relevant Radio on Thursday morning, February 20th, 2014. The Morning Air® show can be heard in Chicago on AM radio 950 Khz. You can stream the audio the next 30 days by visiting http://relevantradio.com/audios/morning-air-with-sean-herriott

I decided to adapt my notes used in preparation for the interview and re-purpose them in a special update. I hope you enjoy it as much as I enjoyed doing the show!

IT’S DESIGNED TO GO UP!

First, we need to take a step back and get a historical perspective. As we enter 2014, the stock market as measured by the S&P 500 is unchanged since the beginning of the year. This is on the heels of a year that gave investors the best returns since 1995. Something in the back of our minds still makes us believe that it’s not safe out there. Everyone should agree that the “truth sets us free”. We are entitled to our feelings, but we are not entitled to ignore the truth.

In 1980, S&P 500 was at 106. As of Feb 2014, it is trading at 1,820. That is 16.0 times higher, not including a 2% to 4% annual dividend yield for last 34 years. That would be like gold selling at over $13,600 an ounce today instead of its current price of 1,300. Said another way, if the S&P 500 behaved like the price of gold since 1980, it would be 91% less than it is today. Stocks are infinitely better than gold to hedge against inflation and the always rising cost of living.

In 1980, the Dow Jones Industrial Average was 850. As of February 2014, it’s trading at 16,000 or 17 times higher, not including dividends. The S&P 500 has produced positive return not including dividends in 25 out of the last 33 years. The truth is that it did this despite the recession of 1985, stock crash of 1987, 1989 mini- crash, the first Gulf War, second Gulf War, Savings and Loan Crisis, 1997 Asian Currency Crisis, 1998 Russian currency crisis, Long Term Capital Management collapse, Y2K, the internet bubble, the attack on the World Trade center and the Great Recession.

The facts provide evidence that the US economy and the indomitable American spirit can handle anything thrown at us. Neither derivatives, war, nor a Nobel Prize winner can kill the economy for long.

To summarize, over the last 34 years it does not matter in the end if interest rates were 21 %, 10% or 3 ½%. Despite all these obstacles, the market continues to chug higher.

IT’S GOOD FOR THE INVESTOR

1.) When a company in the Dow Jones Industrial Average gets below a certain price, they remove it and replace it with a more expensive company. They do this because the Dow Jones Averages is a price- weighted index. The higher the price of the stock, the better it is for the index. Recently removed in 2013 from the DJIA were Alcoa ($8.00), Bank of America ($14.00) and HP ($21). These stocks were replaced by Goldman Sachs ($165), Visa ($192), and Nike ($70). ( approximate prices)

2.) Another action Wall Street does is to shrink the denominator used in its calculation of the Averages. To keep the index “relevant”, the Dow Jones Company over the years has made the divisor smaller and smaller. Today the divisor is .1557159050111. The value of the Dow Jones is actually 2,523, which they divide by .155715, and ‘voila’ you get the current value of 16, 208.

3.) When the stock of a company falls to a level too cheap to be ignored by the Board of Directors (aka a ‘fire sale’) what do they do? Corporations buy back their shares thereby reducing available supply and creating scarcity. This makes it easier for the shares to increase later on. By reducing available supply, any new demand during the next recovery will cause shares rise easier.

4.) When the stock market crashes, the Federal Reserve has shown that it will stop at absolutely nothing to keep the game going. Over the last 5 years, the Federal Reserve has added $3.76 trillion dollars to their balance sheet in reserves. That money has not made it into the economy and is kept on deposit back at the Federal Reserve.

The M2 Money supply has grown at the same pace during 2008-2014, just as it did from 1995-2008. During the next crisis, and there will be many, the banking authorities will stop at nothing to keep the game going.

5.) Instead of expensive mutual funds, investors and money managers have been flocking to Exchange Traded Funds (ETFs) because of their simpler regulatory structure, transparency and favorable tax treatment by the IRS as an “in kind” transaction. These lower costs benefit the market and allow investors to keep more of their money to invest with.

The only possible conclusion we can draw from over 100 years of stock market action is that the forces of demographics, inflation, industriousness, capitalism, technology, reduced labor costs and a 101 other invisible forces at work, may me say the market is designed to go up.

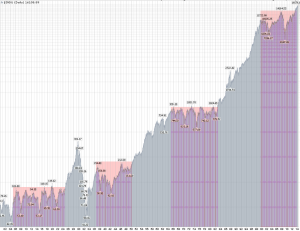

Just take a look at the chart below where I highlighted areas of consolidation, followed by sharply rising stock market performance since 1900.

Chart courtesy of Stock Charts.com

WHAT IT MEANS FOR RETIREMENT INVESTING

The only way I can see how a person saving for retirement will not run out of money over a 30 or 35-year retirement is to change our belief that the day-to-day, week-to-week fluctuations in the market are infinitely less important than running out of cash during retirement.

Owning stocks is not risky; NOT owning stocks is risky. To clarify, when I say to own stocks, I specifically mean broad based exchange traded index funds or sector funds. Individual companies come and go, but the indexes will be around long after we are gone.

We have 100+ years of factual data that proves otherwise. The stock market fluctuates and can be unpredictable, but it not risky.

Do not confuse volatility with loss of principal. In closing, we have to change the definition of what “risk” is in order to have a joyful, prosperous retirement. In my opinion, the fluctuations of the market are much less important than the risk of outliving your money.

Nothing—— absolutely nothing about equity prices in the past can predict or prove where they are going in the future.

But neither can I ignore the steep upward sloping line of the market and know in the back of my mind that if Rip Van Winkle had been a stock investor, he would be enjoying a very plush retirement.

Thank you for your continued trust.

Bill Ulivieri- Principal

141 Fernwood Drive. Glenview, IL 60025

www.cenaclecapital.com

847.686.4800

LinkedIn: https://www.linkedin.com/pub/bill-ulivieri/11/212/7b8

Twitter: https://twitter.com/cenaclecapital

Skype: bulivieri

Disclaimer:

PLEASE READ THIS WARNING:

Cenacle Capital Management only transacts business in states where it is properly registered, or excluded or exempted from registration requirements.

Past performance may not be indicative of future results.

Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy (including the investments and/or investment strategies recommended and/or purchased by advisor), or product made reference to directly or indirectly will be profitable or equal to corresponding indicated performance levels.

Different types of investment involvement involve varying degrees of risk, and there can be no assurance that any specific investment will be either suitable or profitable for a client’s investment portfolio.