Dear Clients and Friends,

“The Game of professional investment is intolerably boring and over exacting to anyone who is entirely exempt from the gambling instinct: Whilst he who has it, must pay to this propensity the appropriate toll.” Economist, John Maynard Keynes

With the goal of not making this issue of Inside Cenacle intolerably boring we are answering questions “speed-dating” style.

Question #1: How can I be a stay at home parent, or work at a company that doesn’t provide a 401K, and still help invest in your families retirement?

Answer: First, is to make sure you have an individual retirement account (IRA) either a Traditional or a Roth IRA. If you don’t have one you can open a retirement account online. Easy Peasey.You can contribute a maximum of $5,500 in 2015. If you are over the age of 50, make it $6,500.

Second, is to make sure your spouse has an IRA also. If not, the same rules apply. Open an account online and contribute the maximum.

Third: Buy two of my favorite books on Amazon: “The Four Hour Workweek” by Tim Ferris; and “School for Startups: The Breakthrough Course for Guaranteeing Small Business Success” by Jim Beach.

Question #2: How much money do I need to put away for retirement?

Answer: Here you start with the end game in mind and work backwards. Even a “back of the envelope” plan is better than nothing You need four pieces of information, and most of those you already know.

- How much have you saved for retirement so far? How much is needed?

- How much are you going to have to put away each month?

- What is the rate of return needed to close the gap?

- Which investment classes have historically produced that return?

Of the four variables we know three of them. Anybody using Excel or an envelope do it. Answer key: #3=8.41%.; #4= S&P 500.

Question #3 How do I eliminate student loan debt, while your family is growing. What should you get rid of first?

Answer: Visit the Dave Ramsey website at www.DaveRamsey.com and start reading the free articles posted on his website.

He would tell you to create a list of all your debt, with the smallest debt at the top, and the largest at the bottom. Pay off the smallest debt, say it’s $50 per month regardless of the interest rate, and pay it off in full, then using that extra $50 per month to pay down the next bill which might be $65 per month.

When you have that one paid off, you start putting $50+65 or $115 a month to the next smallest debt. Follow this practise on and on creating a snowball effect. Results and small positive success, are vitally more important than the annual interest rate.

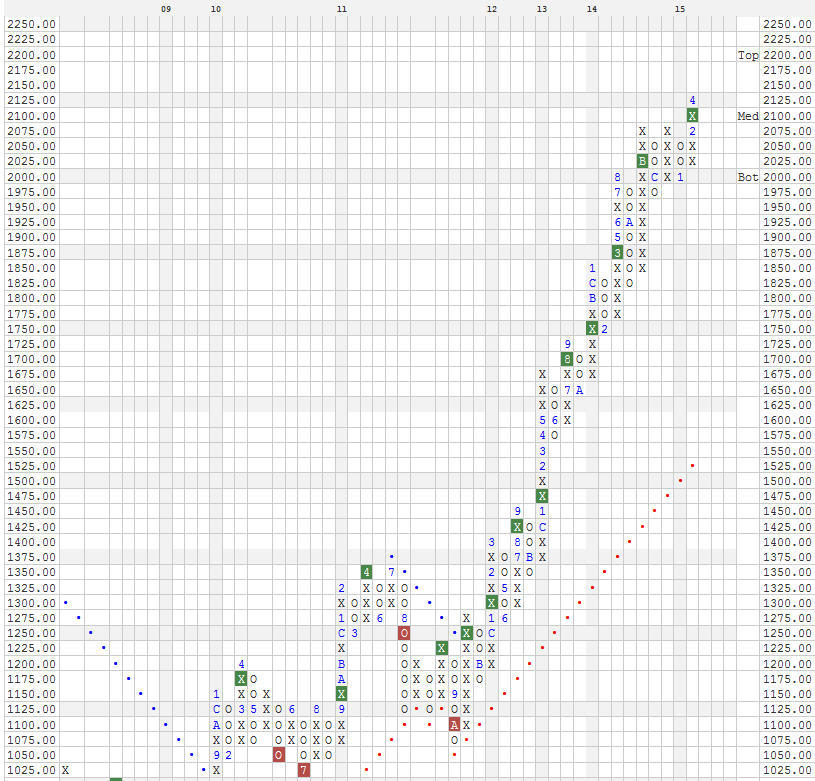

| STOCK MARKET The market may have declined -320 points recently, but that decline hasn’t made a dent in its positive trend. The first “uh-oh” moment for the market is when it starts trading below 1950, or 8.60% off its 2,134 high.  For now, we are still “good to go”, and stories about Greece should be ignored. US stocks are still the highest ranked on the world stage.Still, we expect to see lower prices from now until October, and would view a moderate decline as a place where we would add more stocks.YTD, the S&P 500 is up +0.90, so being cautious hasn’t hurt returns. Our SMART4 model strategy is +6.69 YTD, though individual accounts may differ.If managing your own accounts is too time consuming, please consider having Cenacle Capital manage it for you. We would love to have you on board!Until that changes have a great summer! For now, we are still “good to go”, and stories about Greece should be ignored. US stocks are still the highest ranked on the world stage.Still, we expect to see lower prices from now until October, and would view a moderate decline as a place where we would add more stocks.YTD, the S&P 500 is up +0.90, so being cautious hasn’t hurt returns. Our SMART4 model strategy is +6.69 YTD, though individual accounts may differ.If managing your own accounts is too time consuming, please consider having Cenacle Capital manage it for you. We would love to have you on board!Until that changes have a great summer!

If something should change, I will send a Special Market Update. “The truth is that there is a common bond among all cultures, among all peoples in this world…at least among those who have reached the level of the wheel, the shoe and the toothbrush. And that common bond is that much-maligned class known as the bourgeoisie-the middle class…They are all over the world, in every continent, every nation, every society, every culture,everywhere you find the wheel, the shoe and the toothbrush, and wherever they are, all of them believe in the same things.

|